Pay Pal is widely accepted as a way to pay for things online and for businesses to collect money from their customers. If you’re a business owner, your PayPal credit card fee paid is important. How much are the credit card fees?

PayPal Credit Card Fee

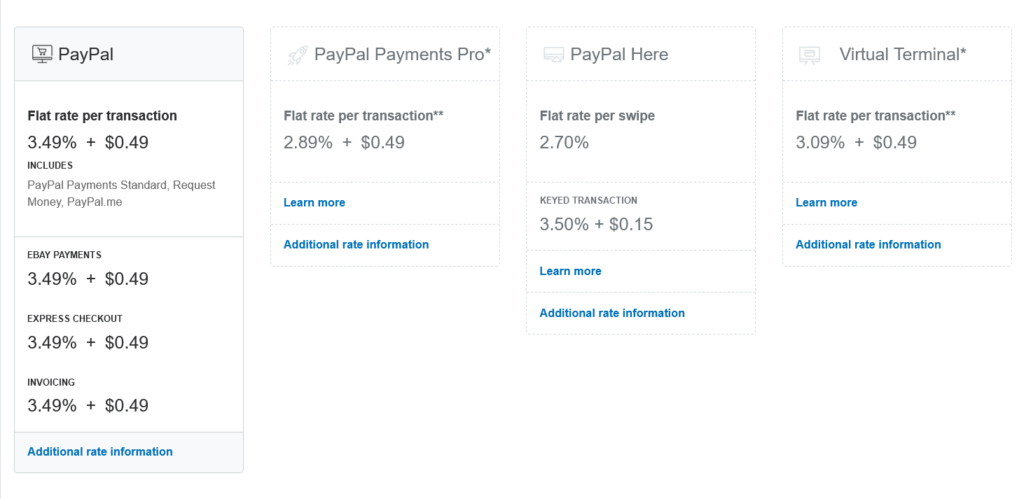

The PayPal credit card fee your small business pays is the rate and per transaction fee. In the simplest terms, you pay between 2.7 and 3.5% for PayPal credit card fees (rates and fixed fees), but that number can vary by more than 20% depending on which features you use and how you collect the payment information.

PayPal profits off of these fees, and it’s also one of the ways credit card companies make money.

What does Pay Pal charge for collecting money? It depends on how it is done. ScrubMoney is here to help.

How Much PayPal Charges for Credit Cards

The amount Pay Pal charges for merchant processing, or credit card fees are made from two parts – the rate and fixed transaction fee. Pay Pal rates and fees vary depending on how you accept payment:

PayPal Standard

Take credit cards online by requesting money or professionally invoicing it. Your customer can either pay with their balance or credit card. All you need is a PayPal account to send and receive money this way. Pay Pal charges credit card fees at a rate of 3.49% and $.49 per transaction.

PayPal Payments Pro

Pay Pal charges credit card fees at a rate of 2.89% and $.49 per transaction. There is also a $30/month fee for PayPal Payments Pro service.

Pay Pal Here

Pay Pal charges credit card fees at a rate of 3.49% and $.49 per transaction. Pay Pal charges credit card fees a flat rate of 2.7% for in person credit card payments (swiping the card), or 3.5% and $.15 per transaction.

Pay Pal Virtual Terminal

Pay Pal charges credit card fees at a rate of 3.09% and $.49 per transaction. There is also $30/month fee for the virtual terminal.

Pay Pal Fees for Woo Commerce

I have a website production company that I use a Woo Commerce shopping cart with PayPal as a payment processor. It allows my customers to easily pay me with credit/debit. Unfortunately, there are Paypal credit card fees for Woo Commerce…

A client hired me for business consulting services, paying me $525. I received $508.81, with a Pay Pal credit card fee of $16.19.

I couldn’t figure out the exact amount I was charged for a rate and fee, but the amount turned out to be just over 3% of the transaction (3.084% to be more precise). I don’t pay any monthly service fee; maybe Woo Commerce has a deal with them. For all research purposes, PayPal charges 3% for credit card through Woo Commerce.

How High Are Pay Pal Credit Card Rates & Fees?

At first, I thought Pay Pal credit card fees were really high – especially when compared to companies like Stripe. But then when I did the comparison above, I realized they are competitive, especially for online shopping. PayPal is widely known – nearly everyone has an account. And if they don’t, they can just enter their credit card to pay for your product or service.

Getting Better Credit Card Rates?

Pay Pal credit card fees aren’t that high when compared to other merchant processors. Want better rates? If you do high volume, you might want to consider other processors, or negotiating directly with Pay Pal.

Any questions? What you think about PayPay credit card fees? Let us know on social media or leave a comment bellow.