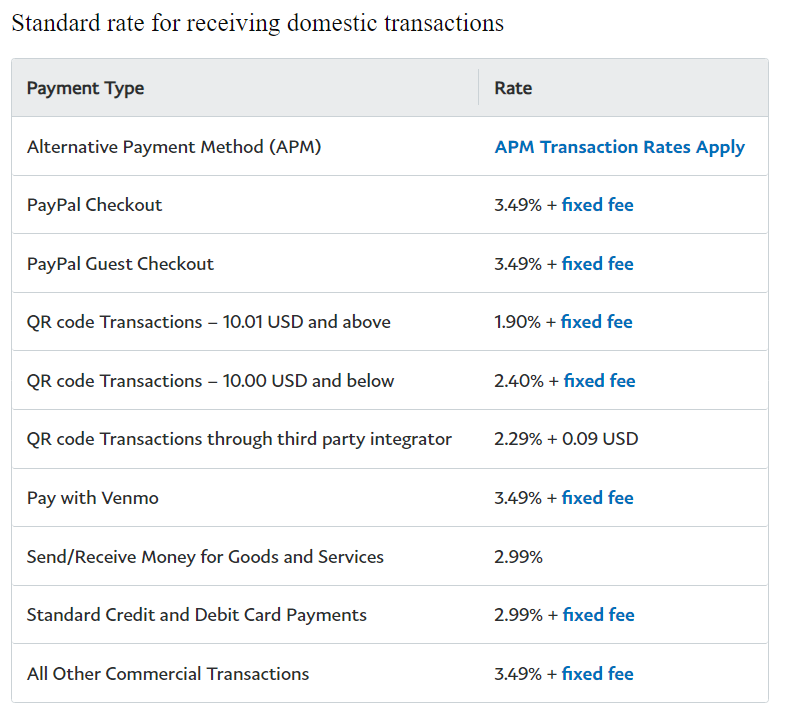

Pay Pal charges fees for credit card transactions. The Paypal credit card fee stay fairly consistent, but they did make some changes in 2023 to rates and services. There are different rates for merchants depending on how they pay – whether using PayPal Checkout, Venmo, or a credit/debit card.

Pay Pal Credit Card Fee

These include the fee for credit and debit card transactions, a lower percentage rate of 2.99%, plus a fixed fee per charge. With US Currency, that fixed fee is $.49 USD. This is 49 cents + 2.99% of the total transaction. It has recently been raise higher with Pay Pal Checkout though, to 3.49%.

A $10 transaction made by credit card would have a total fee of 79 cents, and you would get $9.21 USD deposited to your account. Foreign currencies have different fixed rates, but the same percentage.

PayPal Merchant Credit Card Fees at a Glance

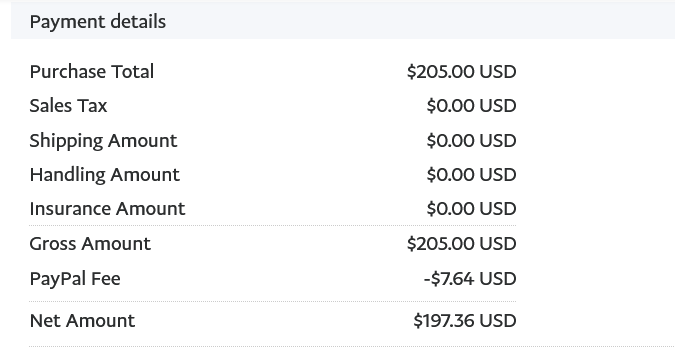

Bellow is an example of what PayPal charged me for a credit card fee. A customer paid $205, and Pay Pay charged me a merchant processing fee of $7.64, or 3.73% of the transaction, which is actually quite a bit. It works out to be 3.49% plus the $ .49 USD per transaction fee. This was high because it was through the PayPal Checkout feature on a shopping cart.

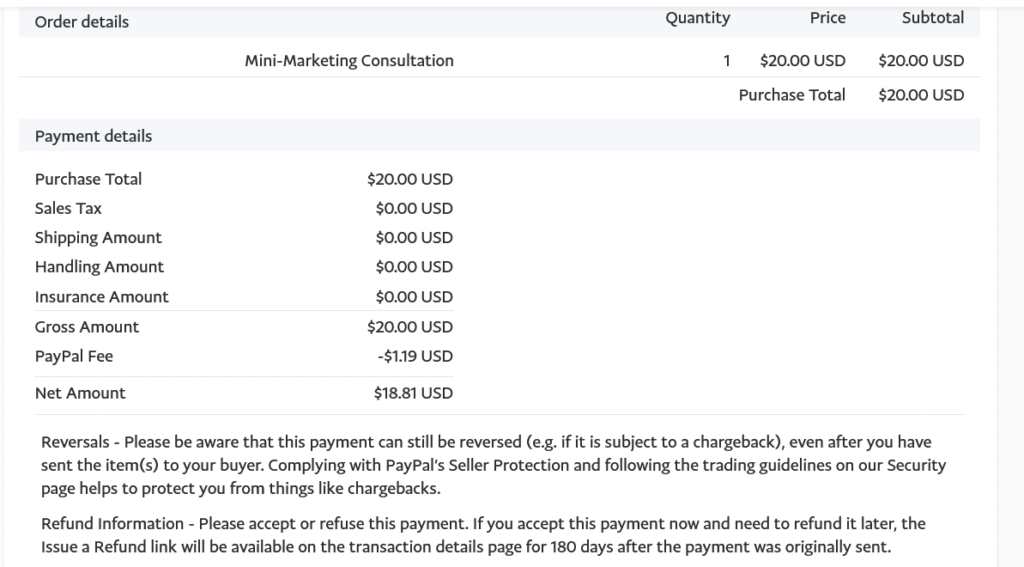

Therefore, the larger the transaction, the lower the overall fee. The per transaction fee + percentage means you’re going to pay 53.48% on one dollar, 8.4% on $10, or 5.95% on $20, as shown bellow. It’s the cost of convenience of taking customer’s money instantaneously online.

All Pay Pal Merchant Fees

Paypal Merchant Fees include credit card fees but vary depending on the method the customer puts in their credit or debit card. They used to charge 2.89% but have moved that up to 2.99-3.49%, which can be a big difference for high value purchases.

I really want to integrate the QR transactions into my business, because the price is so low (1.9-2.4% + transaction fee).

If you can, get cash or check from the customer. This is usually slower, but can really improve your margins. I have a small business customer that just hired me for consulting services, ordered online but paid by check. I saved about $20 in credit card fees!

I love doing the math!

Different PayPal Fees for Credit Card Transactions

There are different credit card fees with Pay Pal, depending how you take them. In depth Pay Pal fees, not just credit cards, are here. See bellow for more info:

How to Get Your Money with Pay Pal

Earning Money With Pay Pal

You can learn how to earn money – send and receive money with PayPal here.

Basically, you either need a physical store location (swipe) , send invoices from your account, or a shopping cart like I use. Make an account and you’re good to go.

Pretty much everyone has a PayPal account, and it’s easy for them to make a purchase, which they can use to justify their slightly higher credit card fees.

Let us know if you have found any different rates.

Stripe Payments Processing – Credit Card Fees

The Stripe Payment processing service has lower credit card fees, but the customer most likely will have to enter their credit card info. They can also pay with Pay Pal, however, I have to check to see what the pricing is through that.

Stripe also offers volume discounts, but you have to contact them direct, which will soon. Make sure to subscribe to the ScrubMoney Newsletter to stay in the loop.

Join the ScrubMoney Newsletter to Keep Cash Flow

Get money tips and tricks at your fingertips with the ScrubMoney newsletter!

Let’s get ScrubMoney!