Buying a home is one of the biggest financial decisions you will ever make both in terms of the amount you will borrow and the length of time you will be committing to the loan. The interest you pay on your home mortgage go up and down based on your credit score. You may be asking, “how your mortgage rate is affected by your credit score?”

The answer is: a lot.

Even if your credit score is “good” it can still mean thousands of dollars more in interest over the life of the loan than if you have a “great” credit score.

Let’s take a look at how much credit scores affect interest rates. An interesting side note, is the prime mortgage interest rate (760-850 credit scores) in 2018 was just over half the current prime rate. 2018 mortgage interest rates were commonly in the 3% range!

You should consider this if you’re looking at if it’s a good time to refinance your home loan.

Home Mortgage Rates by Credit Score

The interest rate you pay on your home mortgage goes up if you have bad credit, and is lower if you have good credit. How much of a difference is your mortgage rate based on your credit score?

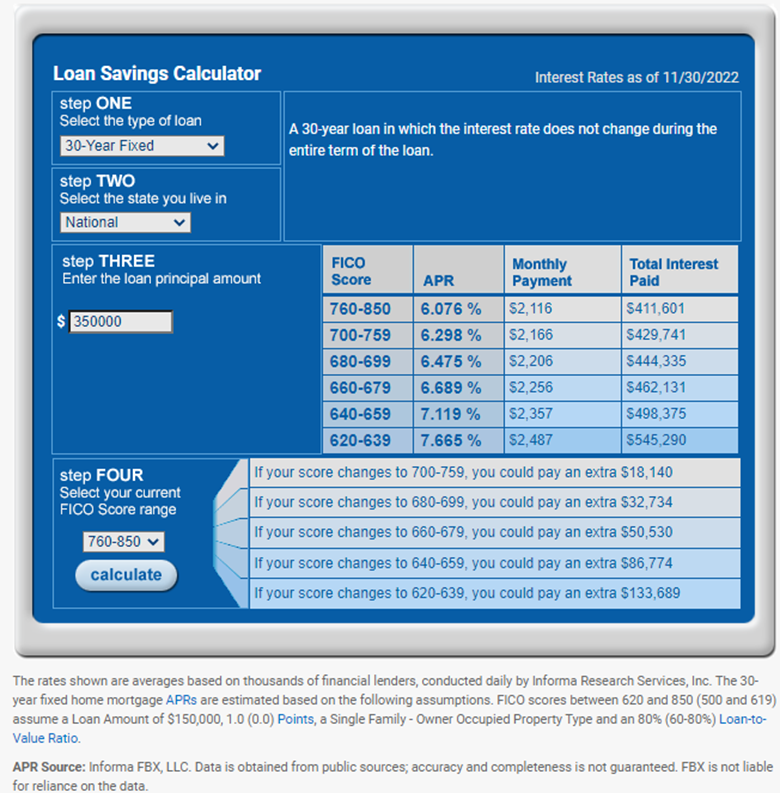

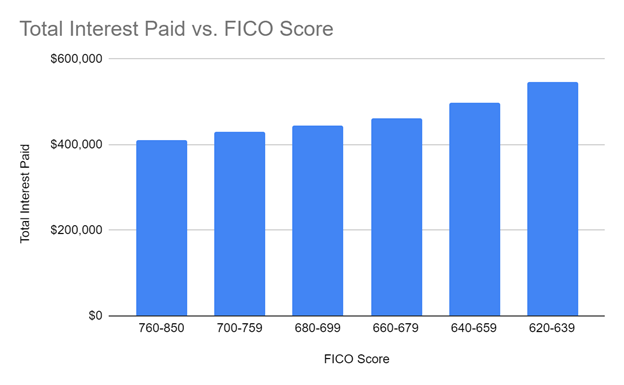

We looked at a 30-Year-Fixed Loan on a National Level and borrowed amount of $350,000 at the end of 2022.

| FICO Score | APR | Monthly Payment | Total Interest Paid |

| 760-850 | 6.076% | $2,116 | $411,601 |

| 700-759 | 6.298% | $2,166 | $429,741 |

| 680-699 | 6.475% | $2,206 | $444,335 |

| 660-679 | 6.689% | $2,256 | $462,131 |

| 640-659 | 7.119% | $2,357 | $498,375 |

| 620-639 | 7.665% | $2,487 | $545,290 |

You can see with this simple example using national data that the lowest credit score at which you can get a mortgage, 620-639, compared to the highest credit score, 760-850, results in $133,689 more in interest. Even using the top two ranges of scores, 760-850 compared to 700-759 results in you paying $18,140 more in interest. Just a slight increase in your credit score saves you thousands. And that is money better in your pocket than the banks.

Why does your credit score affect your mortgage rate so much?

Lenders view your credit score as an indication of the risk of giving you a loan. A low credit score, with lots of late payments and defaults, says to a lender that the risk of lending you money is too high and you won’t get a mortgage with a score under 620.

The higher your credit score over 620 the more likely, from a lender’s perspective, you are to repay the loan on time.

As the risk increases with each jump down in credit score the higher the interest rate they will charge you.

The higher your interest rate the more you repay in interest over the life of the loan. This is because interest on mortgages is compound interest, meaning you pay interest on the interest and that adds up fast.

How to get a lower mortgage rate.

There are two main things you can do to get a lower mortgage rate. Raising your credit score and having a lower loan-to-value ratio. Economic conditions like the Current Federal Funds Rate you cannot affect.

The loan-to-value ratio is the amount of your loan compared to your house value. If you are buying a house valued at $200,000 and you put down 20% you have a ratio of 80%. If you lower this and put a down payment of 30% you can decrease your mortgage rate as well. This is because the risk to the lender is also decreased.

Raising your credit score before applying for a loan will help you lock in lower rates. It may delay you getting your mortgage but spending time and effort to increase your credit score will pay off in the dollars saved in interest.

Here are some things you can do to improve your credit score:

- Review your report and see what is affecting your score

- While you are reviewing your report work to have any errors removed

- Make payments on time – all your payments, all the time

- Pay down credit card debt – this normally is the highest interest you are paying on debt so get rid of it as quickly as possible

- Pay off delinquent balances

As you have seen just a few more points on your credit score can make a big difference to the cost of your mortgage, so take the time to get it right. Review your credit, save as much as you can for a down payment and shop around. Make sure you educate yourself and understand what affects interest rates in general and mortgage rates specifically and use that, along with the best credit score you can get, to get a lower rate and spend those tens of thousands of dollars saved on something else.